Bitcoin ETF Becomes Dominant Asset in Harvard’s Portfolio

16.11.2025

News / Economy / Analytics

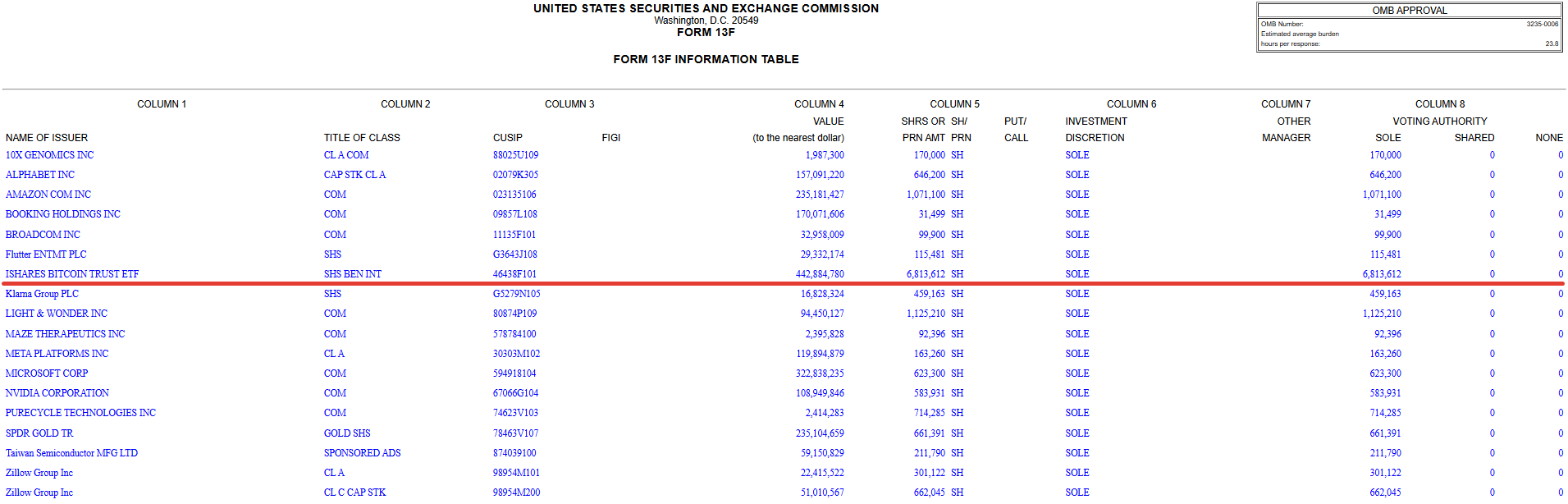

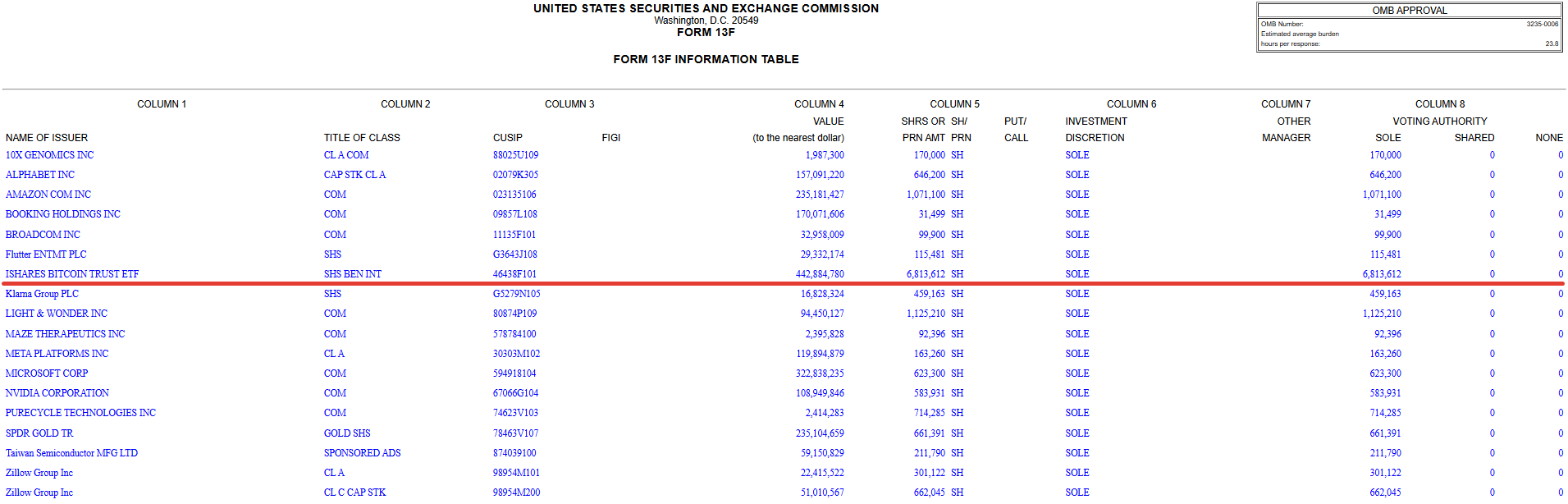

As of the end of the third quarter, Harvard University‚Äôs treasury held 6.81 million shares of BlackRock‚Äôs Bitcoin exchange-traded fund (IBIT), valued at $442.88 million. This is according to a¬Ýreport for the¬ÝSEC.

This position has become the largest in the educational institution’s portfolio, accounting for about 20% of its current volume.

At the end of June, Harvard¬Ýheld IBIT shares worth $116 million. Over three months, reserves increased by 280%.

The second-largest position in the treasury is now Microsoft securities at $322.8 million, followed by Amazon ($235.18 million) and SPDR Gold Trust ($235.1 million).

Bloomberg analyst Eric Balchunas noted the unusual investment direction for American universities.

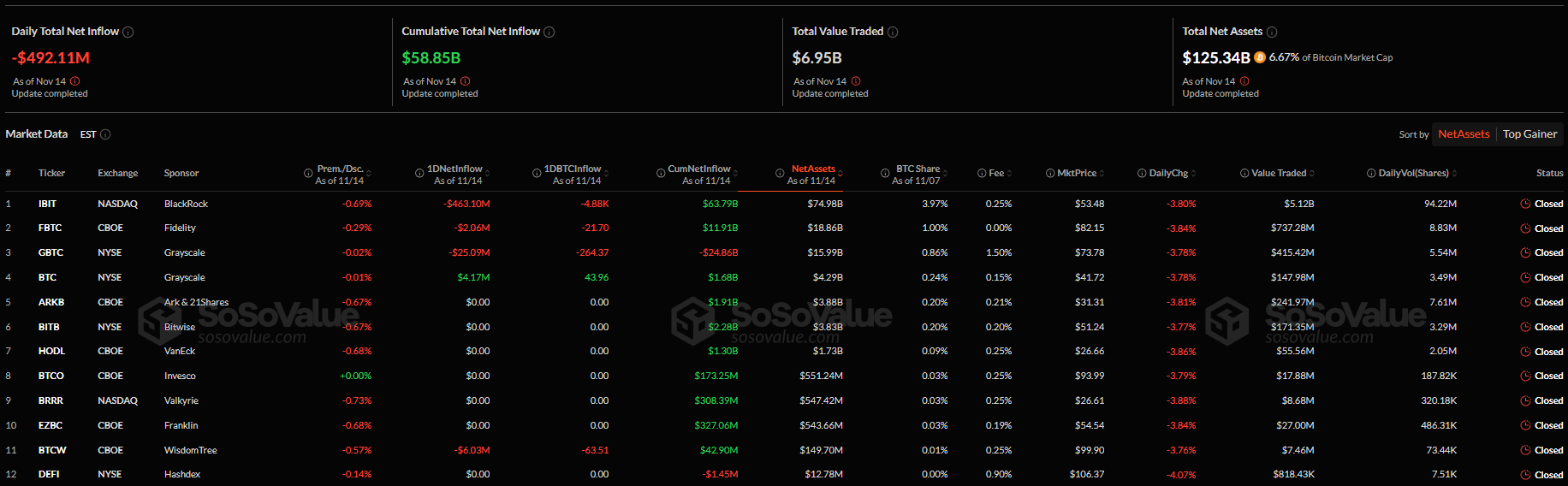

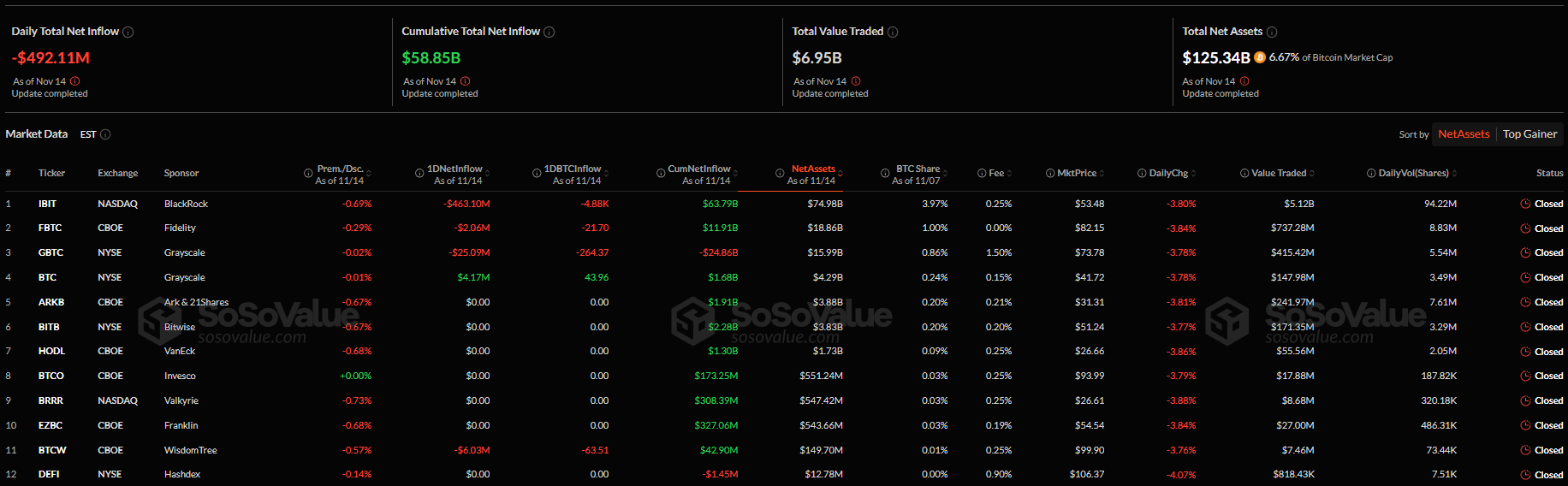

Since its launch, IBIT has remained the world‚Äôs largest Bitcoin-based exchange-traded fund, with net assets under management of just under $75 billion, according to¬ÝSoSoValue. BlackRock‚Äôs ETF has absorbed 3.97% of the first cryptocurrency‚Äôs issuance.

Emory University, a private research institution in Atlanta, has also increased its positions in Bitcoin ETFs. As of September 30, the institution¬Ýheld over 1 million shares of the Bitcoin Mini Trust ETF from Grayscale, valued at $42.9 million. Over the quarter, holdings increased by nearly 90%.

This position has become the largest in the educational institution’s portfolio, accounting for about 20% of its current volume.

At the end of June, Harvard¬Ýheld IBIT shares worth $116 million. Over three months, reserves increased by 280%.

The second-largest position in the treasury is now Microsoft securities at $322.8 million, followed by Amazon ($235.18 million) and SPDR Gold Trust ($235.1 million).

Bloomberg analyst Eric Balchunas noted the unusual investment direction for American universities.

‚ÄúIt‚Äôs extremely rare and difficult to get an endowment to join an¬ÝETF, especially Harvard or Yale. It‚Äôs the best endorsement an exchange-traded product can get,‚Äù he noted.According to him, the current IBIT holdings at the university account for only 1% of the fund‚Äôs target level of $50 billion. Nevertheless, Harvard ranks 16th among the largest holders of the instrument.

Since its launch, IBIT has remained the world‚Äôs largest Bitcoin-based exchange-traded fund, with net assets under management of just under $75 billion, according to¬ÝSoSoValue. BlackRock‚Äôs ETF has absorbed 3.97% of the first cryptocurrency‚Äôs issuance.

Emory University, a private research institution in Atlanta, has also increased its positions in Bitcoin ETFs. As of September 30, the institution¬Ýheld over 1 million shares of the Bitcoin Mini Trust ETF from Grayscale, valued at $42.9 million. Over the quarter, holdings increased by nearly 90%.

Similar news:

23.08.2023